Il Sports Gambling Bill

9th state to legalize

The Senate in Illinois gave their seal of approval to legal sports betting on the final day of the legislative session. Senate Bill 690 was voted through by a vote of 46-10.Most forks for every day can be found on

The state legislature passed a bill allowing for Illinois sports betting at riverboat casinos, horse racetracks and sports facilities in spring 2019. Legalized sports betting will soon come to Illinois as part of the state's new gambling expansion law. Sports wagering is nothing new. But in the U.S., the practice has generally been illegal outside of a few specific venues. That changed last year when the Supreme Court struck down the Professional and Amateur Sports Protection Act. The legislature sent Gov. Pritzker a bill he’s expected to sign that will dramatically expand legal gambling in Illinois. Existing gambling venues get more gaming positions that can be. A major gambling expansion in Illinois that will give Chicago its first casino, allow betting on sports and raise money for a massive infrastructure program won final approval on Sunday in the. SPRINGFIELD - Six new casinos, along with legalized sports betting, are coming to Illinois after Senate lawmakers approved a massive gambling expansion bill Sunday. Senate Bill 690, sponsored.

This means that Illinois is now the latest state to have made sports betting legal. Online sports betting will now be allowed in the state, whether racetracks, casinos or sporting arenas like Soldier Field and Wrigley Field.

One of the promoters of the bill was Representative Mike Zalewski and he professed his delight for its passage. He said: 'Today is the culmination of a tremendous amount of hard work, determination and teamwork behind a vision for entertainment and economic opportunity in Illinois.'

https://www.oriturk.com

bt sport champions league free to air

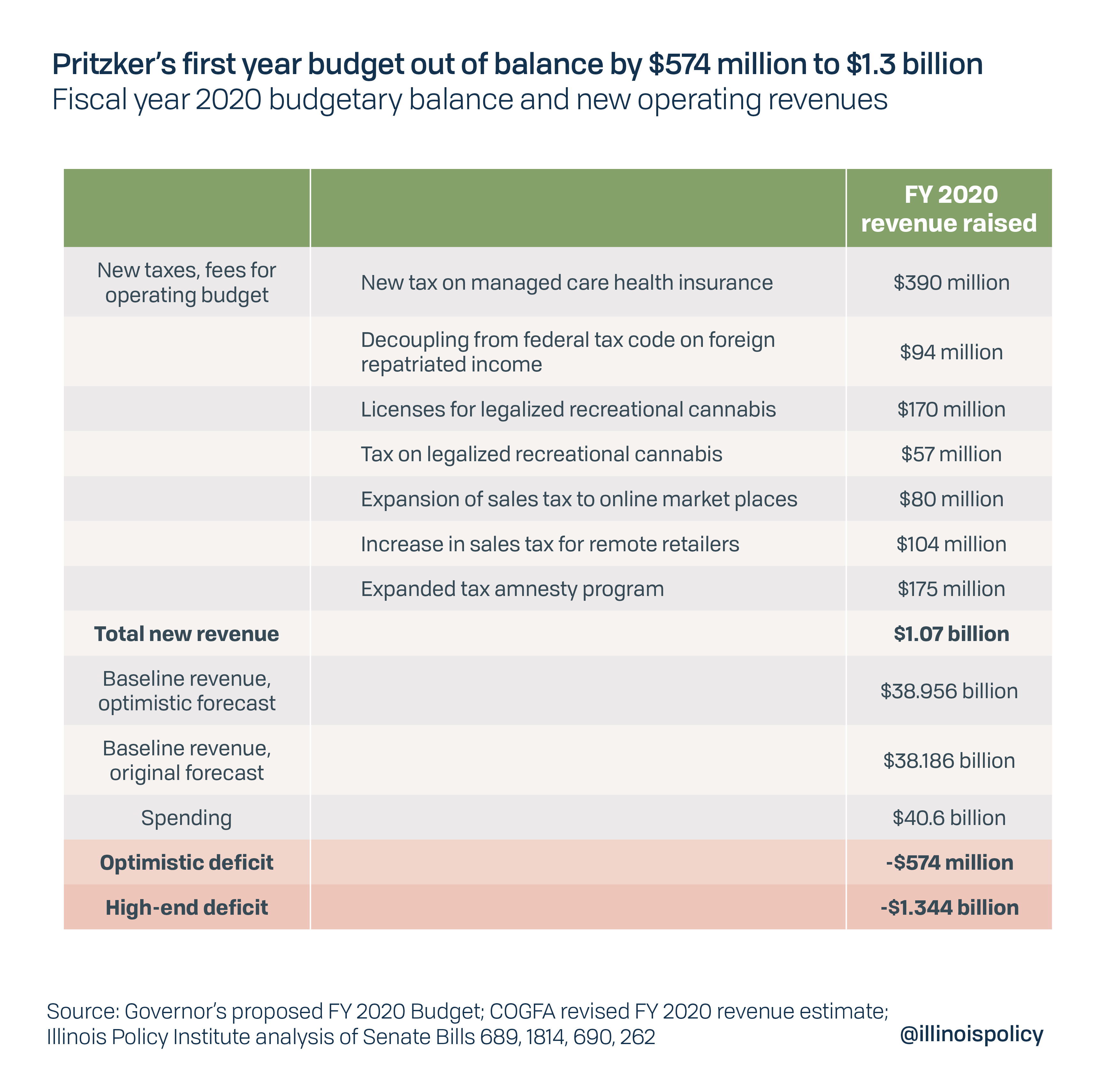

Governor JB Pritzker was a supporter of this bill and he will likely sign it into law in the coming weeks. He included a sum of $200m revenue from sports betting in his 2020 budget proposal. Pritzker went into detail as to what legal sports betting may look like in this regard.

He envisioned 20 licenses being available, permitting both retail and online sports betting, and a tax rate of about 20{38ca874dae1ced1b3eb439ea5edf77bd22037dfda1ce62d6413ab1b8209f1e31} on revenues.

Sporting venues that can seat at least 17,000 people will be able to apply for a master license for sports betting. This means they will be able to offer sports betting within a five-mile radius from their venue. A license will be for a term of four years, with the initial cost to acquire it being $10m.https://www.ourturffb.com

germany bundesliga ii table

9th state to legalize

The Senate in Illinois gave their seal of approval to legal sports betting on the final day of the legislative session. Senate Bill 690 was voted through by a vote of 46-10.Most forks for every day can be found on

This means that Illinois is now the latest state to have made sports betting legal. Online sports betting will now be allowed in the state, whether racetracks, casinos or sporting arenas like Soldier Field and Wrigley Field.

Il Sports Gambling Bills

One of the promoters of the bill was Representative Mike Zalewski and he professed his delight for its passage. He said: 'Today is the culmination of a tremendous amount of hard work, determination and teamwork behind a vision for entertainment and economic opportunity in Illinois.'

https://www.oriturk.com

bt sport champions league free to air

Governor JB Pritzker was a supporter of this bill and he will likely sign it into law in the coming weeks. He included a sum of $200m revenue from sports betting in his 2020 budget proposal. Pritzker went into detail as to what legal sports betting may look like in this regard.

He envisioned 20 licenses being available, permitting both retail and online sports betting, and a tax rate of about 20{38ca874dae1ced1b3eb439ea5edf77bd22037dfda1ce62d6413ab1b8209f1e31} on revenues.

Sporting venues that can seat at least 17,000 people will be able to apply for a master license for sports betting. This means they will be able to offer sports betting within a five-mile radius from their venue. A license will be for a term of four years, with the initial cost to acquire it being $10m.https://www.ourturffb.com

germany bundesliga ii table

The bill does not permit betting on events involving schools in the state.

But there are caveats

While the likes of the MLB and the NBA were using lobbyists to press hard in the state for the inclusion of an integrity fee, there was none in the final draft of the bill. All operators in the state for sports betting will have to buy an official data package from the major sports leagues. This is mainly for those bets that are made after an event has began.

There is also a caveat in the bill whereby companies already in the online sports betting space, such as DraftKings and FanDuel, will have to conduct operations via one of Illinois‘ casinos for the first 18 months.

whos in the champions league final

The bill also has a provision to open more casinos in Chicago and elsewhere in Illinois.https://moegamer.net In total, there will be six new casinos and racetracks will also be able to offer slot machines and table games.

Other niche aspects of the bill include increasing the tax rate for video poker and ensuring a minimum number of hires in the gambling industry by companies. Operators will have to aim for diversity when hiring.

This capital bill has been a long time coming. Its various taxes aim to garner an additional $12bn for the state in the coming years.

Il Sports Gambling Bill

Related Posts

Il Sports Betting Bill

The Illinois Senate passed the gaming expansion bill June 2, 2019, and sent the legislation to the governor’s desk. This GT Alert provides a general summary of the gaming expansion bill followed by a more detailed review of the Sports Wagering Act (the Act). We will continue to monitor the response to the legislation in the coming days and will update this Alert as clarifications and new interpretations become available. The Senate has 30 days from June 2 to present the bill to Governor Pritzker; however, we anticipate that the governor will receive the bill shortly. It is also expected that the Governor will not wait the allotted 60 days to sign the bill into law.

General Overview

Illinois has passed significant gaming expansion legislation. The bill will permit sports wagering, including online/mobile, a Chicago casino, five additional casinos, slots and table games at racetracks, possible slots at the Chicago airports, an additional video gaming terminal at each establishment and in some instances five additional video gaming terminals, and the opportunity for existing casinos to move to land-based operations or purchase additional gaming positions. Along with the expansion, significant taxes and licensing fees are levied.

Sports Wagering

With the appropriate master sports wagering license, the 3 existing horse tracks, the 10 existing casinos, up to three OTBs per track, and up to seven sports facilities (requires 17,000-plus seating capacity) or its designee within five blocks of the sports facility, can offer onsite sports wagering. Each of those groups (tracks, casinos, and sports facilities) may offer online or mobile wagering if the offering is under its brand. Initially, online and mobile wagering is permissible but will require in-person registration/account establishment until such time as an online sports wagering operator is licensed (maximum of three) pursuant to a competitive bid process, which cannot result in a license until 630 days after the passage of the Act. The delay in awarding a license to an online sports wagering operator has been referred to as the “penalty box” provision in the press, impacting large daily fantasy sports (DFS) operators. The Act also establishes a lottery pilot program, which permits sports lottery terminals to be placed at 2,500 lottery retail locations in each of the first 2 years (5,000 total) following the effective date of the Act. The lottery pilot program is repealed on Jan. 1, 2024.

The master sports wagering licensees are taxed at 15% of adjusted gross sports wagering receipts, with the tax payable monthly in arrears, with an additional 2% tax on revenue generated (online/mobile or otherwise) in the city of Chicago. There are also various provisions relating to sharing data with the leagues, official data requirements for in-game betting, and minority, women, disabled, and veteran engagement targets for all licensees under the Act. (See the detailed sports wagering summary below).

Casino Expansion

New Casinos: The amendments permit the Illinois Gaming Board (the Board) to issue a license to 1) the City of Chicago, 2) the City of Danville, 3) the City of Waukegan, 4) the City of Rockford, 5) certain townships of Cook County, and 6) unincorporated Williamson County adjacent to the Big Muddy River. With the exception of the Chicago casino, applications for the other casinos must be submitted within 120 days of the amendments becoming effective. The Board will only consider an applicant if the county board or authority of the host municipality certifies that the applicant met certain criteria including negotiating with the host community in good faith and agreement as to the location. The Board is required to engage with a consultant to conduct a feasibility study for the Chicago casino within 10 days of the effectiveness of the amended Act. Each applicant shall pay $15 million upon issuance of the license and three years later a reconciliation fee equal to 75% of the adjusted gross receipts (AGR) for the most lucrative 12-month period minus any initial per-position payment paid by the specific licensee. The reconciliation fee may be made in two annual installments. In addition to the license fee, the per-position payments are set at $17,500 for the non-Chicago casino (max $35 million) and $30,000 for Chicago (max $120 million). The Chicago casino will have up to 4,000 positions, which it can split by offering slots at the Chicago airports. The other new casinos will be limited to 2,000 positions, except for the one in Williamson County, which can only have 1,200.

Existing Casinos: Existing casinos may conduct land-based gambling with approval of the Board and payment of a $250,000 fee. The existing operators may also add positions but will be required to pay both the per-position fee and the reconciliation fee as set forth for the non-Chicago casinos in the paragraph above. Unless granted an extension by the Board, the existing casinos are also required to make their position expansion election, from 1,200 to up to 2,000 within 30 days of the effective date of the Act. Note that for the existing casinos, the reconciliation fee is a percentage of the additional positions divided by the total number of positions at the casino.

Racetrack gaming operations: The Illinois Gaming Act is amended to grant authority to the Board over racetrack operations. The Board is granted 120 days from the date of the application to grant the organization gaming license to the applicant.

Taxes – Admission and Privilege: The admission tax is left at $3, but the allocation of the tax is spelled out by location. The admission tax is also applied to the racetracks offering gambling games pursuant to the organization licenses. The tax rate remains unchanged for owner licensees for revenue from anything other than table games, with the top privilege tax set at 50% for income over $200 million. For the first time, table games are taxed differently than slot machines. Table game AGR of up to and including $25 million is taxed at 15%, and any AGR over $25 million is taxed at 20%. Also, the Casino Queen is given an additional downward adjustment to its AGR. Although the language is not clear, the Chicago casino appears to be exempted from the privilege tax schedule, but simply has a tax of one-third of AGR. The existing casinos receive a dollar-for-dollar credit not to exceed $2 million for renovations or construction costs through 2023. If the existing casinos have a lower AGR in 2019 (or subsequent years) than they did in 2018, the privilege tax liability is reduced until AGR equals the amount of AGR in 2018 (3% cap unless the cap is expanded due to non-gaming improvement spend). The reduction in liability is not refunded but applied as a credit against the subsequent year’s taxes. The adjustment period under this provision can be extended by spending $15 million in non-gaming amenities (subject to a cap of $75 million in successive years). All the construction work must be union contracts to be eligible for the tax credits. Beginning in 2020, free play up to 20% of AGR is excluded from gross receipts. In March 2023, the Board is required to report to the General Assembly on the impact of the free play provision for the years 2020-2022. The Act details how the taxes received from the new casinos will be split among the various municipalities – significantly, the tax revenue from the Chicago casino (subject to appropriation) will be applied to the city’s obligation to fund pension payments.

Miscellaneous Provisions, including Test Labs and Diversity Requirements: Amendments also require the Board to use multiple accredited testing labs regardless of contractual obligations or discretion, mandate the approval of internal control changes if the Board has not acted on the proposed changes within 90 days, strengthen the ethics controls on Board members, and revise the criteria to be appointed to the Board. The bill clarifies the disclosure of ownership in the public 5.1 disclosures. New section 5.3, “Ethical Conduct,” was added to prevent gifts or influence with the host communities of the new casinos, requiring all communication between the host communities and prospective licensees to be disclosed to the Board. Violation of this new section 5.3 is a Class 4 felony. New Section 230 ILCS 10/6(a-5) sets forth additional and new criteria for applicants for an Owners License. These new criteria include history and success of developing tourism facilities ancillary to gaming, the creation of living wage jobs for Illinois residents, the projected number of jobs to be created, commitment to community-based organizations, identification of adverse effects and the ancillary costs of those effects, and engagement with minorities and women-owned business. The most significant criteria for new applicants is a requirement to demonstrate best efforts to reach a goal of 25% minority ownership and 5% women ownership.

The bill also mandates a diversity program for all licensees that includes annual reporting and makes achievement in diversity inclusion a criteria for the renewal of a license. The focus of the diversity language not only includes vendor spend but also employee engagement and advancement. Copies of the licensee’s annual report on its diversity efforts will be provided to the state legislature. 24-hour gaming is expressly authorized for owners licensees (but not organizational licensees). And a provision appears in both the Illinois Gambling Act and Video Gaming Act that makes it clear that conflicts in the two Acts are resolved in favor of the Illinois Gambling Act.

Video Gaming Amendments

Licensed establishments may offer up to 6 Video Gaming Terminals, except that a new establishment license category is established for large truck stop establishments, which may operate up to 10 video gaming terminals. These large truck stop establishments must be within three miles of the freeway and have volume exceeding 50,000 gallons per month. Terminal Handlers are able to access the logic door and other internal mechanisms of the Video Gaming Terminal without the physical presence of a Board agent. Maximum wagers are increased from $2 to $4, and the maximum jackpot (excluding the progressive $10,000 bonus) is increased from $500 to $1,199 (to avoid W2G issuance). The Board is required to issue emergency rules for the progressive bonus within 90 days of the effective date of the Act. Beginning July 1, 2019, an additional tax of 3% is implemented on net terminal income. On July 1, 2020, the tax increases to 4%. New language placing restrictions on “video gaming malls” is introduced, leaving the Board to make determinations about the application of the restriction.

Horse Racing Expansion

Through a new Section 230 ILCS 5/56, the Horse Racing Act is amended to allow racetracks to apply to the Board for an organization gaming license. Per the amendments to the Riverboat Gambling Act, which becomes the “Illinois Gambling Act,” the number of gaming positions at a racetrack are limited to 1,200 for the track located in Cook County and 900 positions for any tracks outside of Cook County. The positions may include table games. There is a provision that permits the Board to retain unused positions and reallocate those positions to the tracks that want them (in excess of the maximums). (See 230 ILCS 10/7.7). The tracks are required to pay the per-position fee that the casinos are required to pay ($17,500), but the Madison County track is only required to pay for 540 positions, regardless of an election exceeding 540. The reconciliation payment described above also applies. The amendment also prohibits additional regulation of the organization gaming licensees by the local municipality. (See 230 ILCS 10/7.8)

A number of requirements surround the issuance of the organization gaming license including specifics around capital contributions, proceeds contributed to purses, and contributions to the Horsemen Associations. Following the authorization of gambling games at the tracks, the amendments institute a $0.40 admission tax per patron (which is inconsistent with language amending the Riverboat Gambling Act) and adjustment to a number of bonds, fees and payments, including the maximum discipline the Racing Board is authorized to issue and discontinuing the subsidy based on the 1994 purses once gambling games are authorized. The amendment also establishes the pari-mutuel tax rate as a percentage of handle, topping out at 3.5% for handle that is 175% or more above the 2011 average daily pari-mutuel handle. Language has also been added to safeguard against the appropriation of the various Illinois Breeders Trust Funds, giving incentive to races involving Illinois horses, and requiring an annual contribution of $1 million by all tracks to backstretch workers once gambling games are operational.

The amendments also permit a new Standardbred track in Cook County that may have up to 16 inter-track wagering locations. The new track will have all rights that the existing tracks have including sports wagering and up to 1,200 gaming positions.

Finally, the definition of pari-mutuel wagering (Section 3.12) was amended to expressly exclude historical race wagering.

Miscellaneous but Significant Provisions

Illinois Transfer Tax and Withholding Requirements: The newly added 35 ILCS 5/201(14)(b-5) imposes a surcharge on the sale or exchange of assets, properties and intangibles of an organizational licensee equal to the amount of federal income tax liability for the sale or exchange. The surcharge is in effect from 2019-2027 and will not apply in certain instances including bankruptcy, loss of license, death of current owners, or a transfer by any licensee that is not an “initial licensee.” The Illinois Department of Revenue is authorized to adopt rules to administer this section. “Initial licensee” is not defined in the Act. In addition, a separate provision, 25 ILCS 5/710(a)(3), is amended to require tracks, casinos, or any gaming facility to withhold state income tax.

Gaming Board Closed Session Fix: The Open Meetings Act was amended to expressly permit the Board to discuss personal, commercial, financial, or other information that is considered confidential in closed session. The absence of this provision previously had resulted in a number of lawsuits relating to violations of the Open Meetings Act.

Board Member Political Party: No more than three members of the Board may be from the same political party.

Detailed Summary: Sports Wagering Act (Article 25)

Board Authority

- Except for the lottery pilot program, which will be regulated by the Illinois State Lottery, the Illinois Gaming Board will regulate all manner of sports wagering.

- The Board is granted the customary rule making authority and broad discretion to implement the Act. The Board’s authority includes the awarding of all licenses (other than the central communication system for the lottery program), but also whether licensees are permitted to share data with the leagues, what wagers may be restricted at the request of various stakeholders, and, in certain circumstances, whether official data is required for in-game betting.

Wagering Restrictions

- The bettor must be at least 21 and physically located in the state.

- Wagers cannot be placed on any minor league sports events or any Illinois collegiate teams – and, as much reported, wagers cannot be placed on any kindergarten through 12th-grade sporting events.

- In addition to the established limitations or those set by the Board, the casinos, racetracks, sports facilities, online operators, professional sports team, league, association, sports-governing body, or institution of higher education may request that the Board prohibit certain wagers if the requesting party believes that wagering is “contrary to public policy, unfair to consumers or affects the integrity” of either the sport or the sports betting industry. (25-15(g))

- For the sports facility to offer sports wagering, each professional sports team that plays at that venue must give written authorization to the venue.

Licenses

- Sports wagering, subject to licensure, can be offered at 1) the three horseracing tracks (organizational licensees) 2) up to nine OTBs (3 per track), 3) the 10 existing casinos, 4) up to seven sports facilities, and eventually by three online operators.

- The Sports Wagering Act authorizes the Board to issue licenses in six different categories: (1) master sports wagering, (2) occupational, (3) supplier, (4) management services provider, (5) tier 2 official league data provider, and (6) central system provider.

- Master Sports Wagering - This license is awarded to the operators of the casinos, the horse tracks, the sports facilities, and, eventually, the three (maximum) online operators awarded the license pursuant to the competitive bid process.

- Occupational – Self-explanatory. These are the individuals who work for the other licensees issued pursuant to this Act.

- Supplier – These are the technology providers or other suppliers to the Master Sports Wagering licensee. Treated like a traditional supplier – all hardware and software are required to go through independent testing labs.

- Management Services Provider – These are any suppliers taking a share of the revenue, any third party the Master Sports Wagering licensee engages with to run the sports wagering operation, or anyone else deemed a Management Service Provider by the Board.

- Tier 2 Official League Data Provider – Self-Explanatory. As noted elsewhere, this licensee is only for providing data for in-game betting.

- Central System Provider – This licensee runs the central system under the lottery pilot program, is selected following a competitive bid, and is regulated by the Illinois State Lottery and not the Illinois Gaming Board.

- The Board determines the scope of licensing, but the Act requires fingerprints and release of information from all officers and directors of a corporation, all members of an LLC, and all partners of a partnership.

- The Board is authorized to accept licensing by another jurisdiction as evidence that the supplier applicant or management service provider meets the necessary requirements (25-50(c) and 25-55(c)). This same provision is not in the licensing section for any of the other four licensing groups (master sports wagering, occupational, tier 2 official League Data, or Central System Provider)

Taxes

All master sports wagering licensees are taxed at 15% of adjusted gross sports wagering receipts, with the tax payable monthly in arears (25-90(a)), with an additional 2% tax on revenue generated within the city of Chicago. (25-90(a-5)). There is a distinction in 25-90(a-5) between terrestrial and online/mobile wagering.

Fees and Renewals

Initial Master Sports Wagering License (four years):

- Existing Horseracing Tracks - 5% of handle from the preceding calendar year or the lowest master sports wagering licensee fee paid by casino operators, whichever is greater. The fee cannot exceed $10 million. The tracks are required to pay the fee on July 1, 2020.

- Future Horseracing Tracks - $5 million, but that amount will be adjusted (up) based on the handle from the first 12 months of operations.

- Casinos – 5% of AGR for the preceding calendar year, not to exceed $10 million. The casinos are required to pay the fee on July 1, 2020.

- Sports facilities - $10 million

- Online Sports Wagering Operator - $20 million

Fees for Renewal Master Sports Wagering License (four years) - $1 million

Supplier: $150,000 for the initial license (four years) and then $150,000 annually for each renewal (one year).

Management Services Provider: $1 million for the initial license (four years) and then $500,000 for each renewal (four years).

Tier 2 Official Data Provider: The licensing fee for the initial license (three years) is payable to the Board at the end of the first year of licensure based on the amount of data sold to master sports wagering licensees as official league data as follows: (1) for data sales up to and including $500,000, the fee is $30,000; (2) for data sales in excess of $500,000 and up to and including $750,000, the fee is $60,000; (3) for data sales in excess of $750,000 and up to and including $1,000,000, the fee is $125,000; (4) for data sales in excess of $1,000,000 and up to and including $1,500,000, the fee is $250,000; (5) for data sales in excess of $1,500,000 and up to and including $2,000,000, the fee is $375,000; and (6) for data sales in excess of $2,000,000, the fee is $500,000. The renewal license (three years) uses the same metrics but is based on the previous year’s fee.

Central System Licensee: $20 million upon being awarded the contract with the Lottery following the competitive bid process. The length of time for the award of this contract is not dictated in the Act.

Data and Integrity Issues

- The Board may require the licensees to share sports wagering account data in real time with the Board and, if a sports governing body has notified the Board that such data is “necessary and desirable,” the licensees may share that information with the sports governing body, so long as that body only uses that information for “integrity purposes” (25-15(f)).

- The Board and the licensees “may” but are not required to cooperate with investigations conducted by sports governing bodies (25-15(h)). The licensees are required to disclose to the Board any abnormal wagering, breach of protocol, violations of the Act, etc.

- Licensees may use any data to determine the outcome of “tier one” wagers (not in-game wagers) (25-25(f)).

- If a sports governing body headquartered in the United States notifies the Board of its desire to supply official data for in-game betting, the licensees must use such data. If the sports governing bodies do not make this notification, the licensees may use any data. The licensee, with the approval of the Board, is relieved of the obligation to use official data if the official data limitations frustrate the desired in-game bet (25-25(g)).

- The Act establishes a hotline for anonymous reporting of prohibited conduct and obligates the Board to investigate reasonable allegations on a confidential basis (25-75).

- The Act prohibits a master sports wagering licensee (but not other licensees) from purchasing an athlete’s personal biometric data unless it received written permission from the athlete’s “exclusive bargaining representative” (25-80).

Il Sports Gambling Law

Other Provisions

- The Act goes into great detail regarding minority, disabled, women, and veteran vendor engagement and reporting (25-85). This section also sets forth an annual job fair requirement.

- The Act establishes a sports wagering self-exclusion option (25-100).

- The Act requires the Board to provide a report on sports wagering on or before Jan. 15, 2021 and every year thereafter.

- The Administrative Procedure Act is amended to permit for emergency rules to be issued by the Board and the Lottery to implement the Sports Wagering Act. Similarly, the criminal code and other relevant state acts are amended to account for permissible sports wagering.